India’s startup ecosystem is preparing for a significant moment in its evolution. After a historic 2024 that saw nearly 13 startups raise close to Rs 290 billion through initial public offerings, the new financial year is expected to take things even further. With close to 25 startups aiming to raise more than Rs 550 billion in 2025, the Indian primary markets are in for a massive year. These companies come from a wide range of sectors including fintech, edtech, consumer tech, and e commerce, each bringing its own story of growth, innovation, and market traction.

The momentum is not surprising. Retail participation has surged, the Indian consumer market continues to expand, and digital first companies have grown stronger thanks to structural advantages like UPI integration, mobile accessibility, and policy support for digital India. The broader IPO market has also matured, with investors showing a preference for companies that bring real revenue traction and sustainable business models over mere hype.

Among the most anticipated names is Groww Invest Tech, a fintech platform that has become one of India’s most popular investment apps. Since its launch in 2016, Groww has expanded from offering mutual fund services to now being a full service brokerage platform offering stocks, ETFs, digital gold, and even IPO investments. As of January 2025, Groww ranks as the number one stock broker by active clients according to NSE data. Its user friendly design and focus on young investors have made it a standout. While the final IPO size is not confirmed, industry estimates suggest a possible raise of up to 700 million dollars. The IPO is expected to be structured mainly as an offer for sale with a smaller portion allocated to fresh issue.

Another key player entering the IPO race is Urban Company, formerly known as UrbanClap. It is the country’s largest digital marketplace for home services, ranging from salon and grooming to appliance repair and pest control. According to its draft prospectus, the IPO will consist of a fresh issue worth Rs 4.29 billion and an offer for sale by existing investors like Accel, Elevation Capital, and Tiger Global. The total deal size is expected to be around Rs 19 billion. The Indian home services market is projected to grow substantially in the coming years, and Urban Company is well positioned to tap into that demand.

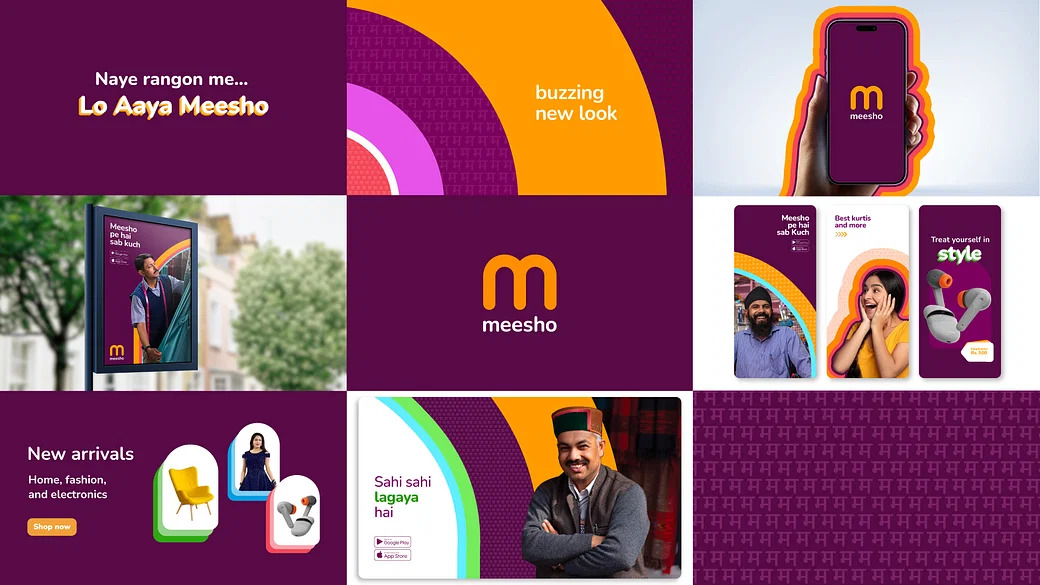

Meesho is also on the list of high profile IPOs for 2025. The e commerce platform has carved a niche for itself by catering to resellers and small businesses, especially in smaller towns and cities. It charges zero commission and uses advanced AI technology for customer support and inventory management. With more than 100 million active users and growing rapidly in non metro regions, Meesho is planning to raise Rs 85 billion, of which Rs 42.5 billion will be new capital. The company filed its draft prospectus recently and is aiming for a listing between September and October. Its pricing and scale suggest that it could be one of the largest IPOs in the consumer tech space this year.

In the education sector, PhysicsWallah is expected to become the first edtech company to list on the Indian exchanges. Known for offering high quality, low cost courses for competitive exams and school education, PhysicsWallah has seen rapid expansion in Tier 2 and Tier 3 cities. The IPO size is expected to be in the range of Rs 42.8 to 46 billion. Despite facing losses due to expansion costs in FY24, the company’s unique hybrid model and accessibility focused approach give it a distinct place in India’s evolving education market.

Rounding out the list is Wakefit Innovations, a fast growing sleep and home furniture brand that aims to raise around Rs 4.68 billion through its IPO. The company plans to use the fresh capital for opening more retail stores, upgrading manufacturing equipment, and strengthening its brand presence. With a diverse product range including mattresses, sofas, wardrobes, and smart sleep technology, Wakefit has already established a retail footprint in over 30 cities and operates five manufacturing plants across India. Its focus on innovation and affordability is likely to resonate with a growing base of middle income consumers.

Each of these startups presents a different angle of India’s consumer and digital growth story. They have shown strong revenue models, increasing customer loyalty, and the ability to scale operations across diverse regions. However, investors are advised to be cautious. The Indian IPO market, especially in the startup space, has produced both major success stories and cautionary tales. For every Zomato that delivered solid returns, there has also been a Paytm that struggled post listing. It is important to study fundamentals, governance standards, and valuation before making an investment decision.

The IPO wave of 2025 is not just a sign of companies growing up. It reflects a broader maturity in India’s capital markets, with deeper retail participation, a wider array of investment products, and stronger regulatory oversight. The coming months will show whether this optimism translates into long term investor value.

For more updates on IPOs, market trends, and smart investing tips, follow You Finance on Instagram and Facebook. Stay ahead of the curve with You Finance.