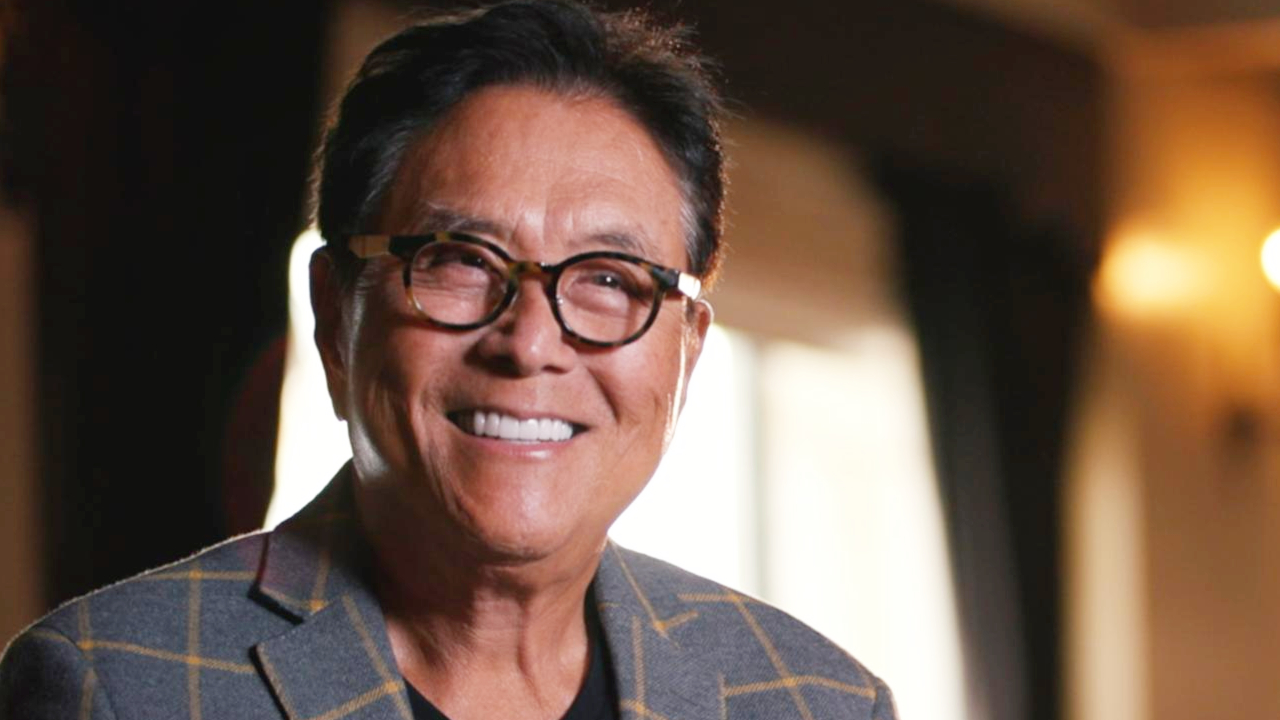

As Bitcoin races past the $120,000 mark for the first time in its history, author and financial commentator Robert Kiyosaki is sounding the alarm. Known for his best-selling book Rich Dad Poor Dad, Kiyosaki took to social media to share a stark message about the state of the global economy. While many celebrate the ongoing crypto rally, he reminded his followers of one crucial detail. Warren Buffett, one of the most trusted names in investing, is no longer in stocks and is holding on to an estimated ₹29 lakh crore in cash.

This, according to Kiyosaki, is not just a financial move. It is a sign. He believes Buffett is waiting for a major crash that will present the next big opportunity to buy high-value assets at rock-bottom prices. Kiyosaki, who has long supported Bitcoin and alternative assets like gold and silver, confirmed that he will be buying just one more Bitcoin before he stops further purchases. The reason, he says, is that even in a strong bull run, he wants clarity about where the economy is heading.

In his post, Kiyosaki emphasized that the current boom in cryptocurrency could lead to significant losses for people who invest blindly. He noted that being greedy in the market can backfire, stating that “Pigs get fat. Hogs get slaughtered.” He said he is adding one last coin to his crypto holdings, but will not make additional purchases unless he sees the bigger economic picture becoming clearer. His advice to new investors was simple and serious start small, stay aware, and never be reckless.

At the same time, Bitcoin touched an all-time high of $123,153 before settling slightly lower. The surge comes just ahead of a major discussion in the US House of Representatives, where lawmakers are debating the framework for regulating cryptocurrencies. This debate has gained urgency as the digital asset market continues to grow, and as major political figures like Donald Trump openly embrace the sector. Trump recently called himself the crypto president and has urged policymakers to support innovation in the space by modernizing regulations.

Despite the current enthusiasm, the crypto rally is unfolding in a climate of global financial uncertainty. Inflation, job cuts, and geopolitical conflicts continue to threaten economic stability. This is why voices like Kiyosaki’s resonate. He is not against investing. He is in fact doing so himself. But he is cautioning people not to confuse hype with strategy.

For younger investors who may feel the pressure of missing out, Kiyosaki’s words act as a sobering reminder that financial freedom comes from discipline and planning. He pointed out that investing should never be rushed, and especially with volatile assets like Bitcoin, the journey should begin with tiny steps rather than giant leaps. The mention of buying just a satoshi, the smallest unit of Bitcoin, highlights his belief in accessibility while promoting financial wisdom.

Meanwhile, Warren Buffett’s decision to sit on massive cash reserves has become a key talking point. For many, Buffett’s move is a signal that seasoned investors are preparing for turbulence rather than chasing short-term highs. It serves as a powerful contrast to the frenzied buying seen among retail investors during crypto surges.

As the global economy stands at a crossroads and digital assets gain political and public traction, Kiyosaki’s message is rooted in a simple principle. Be smart, be patient, and above all, be prepared. The road ahead may offer unprecedented opportunities, but only for those who tread it with caution and clarity.

For more updates on Bitcoin, market trends, and personal finance insights, follow You Finance on Instagram and Facebook.