India is laying the groundwork for what could be one of the biggest transformations in its banking sector in over a decade. In early stage discussions, the Finance Ministry and the Reserve Bank of India are considering a series of proposals designed to energise credit growth, attract global capital, and build large, competitive banks capable of powering the country's economic ambitions. These reforms aim to address structural limitations that have restricted the sector’s expansion and efficiency over the years.

At the core of the discussion is the idea of making it easier for new players to enter the banking space. Large corporates may be allowed to apply for banking licences, a move that would reverse the long standing restriction introduced in 2016. That ban was put in place to prevent conflicts of interest and ensure financial stability. Under the proposed framework, conglomerates could receive licences but would be required to operate within strict regulatory controls. Their shareholding and influence over banking operations would be capped to avoid any overreach.

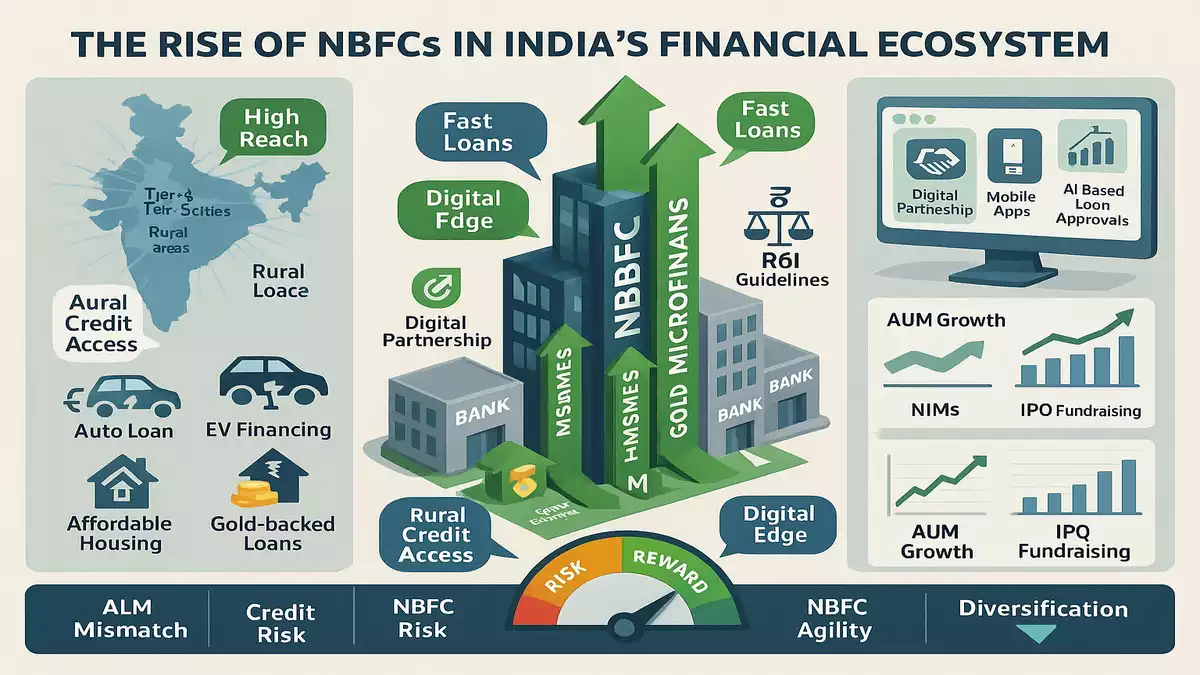

Another major focus is on non bank finance companies. The government wants to encourage financially sound NBFCs to convert into full fledged banks. This shift would not only bring more players under the banking regulatory umbrella but would also enhance credit distribution, especially in regions where traditional banks have limited presence. Southern India has been specifically highlighted as a target area for these upgrades, owing to its rapid industrial development and its emerging role as a manufacturing hub for global giants like Apple.

Additionally, a significant part of the conversation is around foreign direct investment. Currently, FDI in public sector banks is capped at 20 percent and requires government approval. Authorities are exploring the possibility of raising this limit to draw in more international capital while still retaining public control. This is particularly important for India, where a vast majority of the population relies on state run lenders for their banking needs. Even as the government considers liberalising FDI norms, it remains committed to keeping a majority stake in public banks.

To further enhance the strength and size of the banking system, the idea of merging smaller banks is also back on the table. The goal is to create a few large, globally competitive institutions that can match the scale of international counterparts. At present, only State Bank of India and HDFC Bank figure in the top 100 global banks by assets, highlighting how much room there is for growth.

India’s current banking credit stands at around 56 percent of GDP. For the nation to meet Prime Minister Narendra Modi’s vision of becoming a developed economy by 2047, this figure needs to increase significantly. Experts estimate that credit availability will have to rise to about 130 percent of GDP to support a thirty trillion dollar economy. Achieving this will require both regulatory easing and a strong push for capital formation within the banking system.

Investor interest in Indian banking is already showing signs of momentum. In a recent development, Sumitomo Mitsui Financial Group of Japan invested over thirteen thousand crore rupees to acquire a twenty percent stake in Yes Bank. This is the largest foreign investment in the Indian banking space so far and underscores the growing global appetite for a stake in the country’s financial future.

The markets have responded positively to the news of these possible reforms. The Nifty PSU Bank Index, which tracks the performance of state run banks, reversed its losses and moved into positive territory. The index has already gained close to eight percent this year, and further policy clarity could drive renewed investor optimism.

These proposed reforms represent a major shift in the way India views and governs its banking sector. While the talks are still in the early stages, the direction is clear. India is preparing to build a future ready financial system, one that is more inclusive, more competitive, and better equipped to support a fast growing economy.

For more updates on major financial reforms, policy shifts, and investment trends, follow You Finance on Instagram and Facebook.