Arbitrage funds are having a moment in the spotlight, and the timing could not be more telling. As equity markets continue to swing unpredictably and global uncertainties rattle investor confidence, many have turned to this unique category of mutual funds that offer stability, tax benefits, and competitive post tax returns. The latest figures tell the story clearly. In April 2025, arbitrage funds attracted more than eleven thousand crore rupees in inflows, but May set a new benchmark altogether with an unprecedented fifteen thousand seven hundred crore rupees entering the category. The total assets under management have now crossed two lakh thirty four thousand crore rupees as of May end, according to data from the Association of Mutual Funds in India.

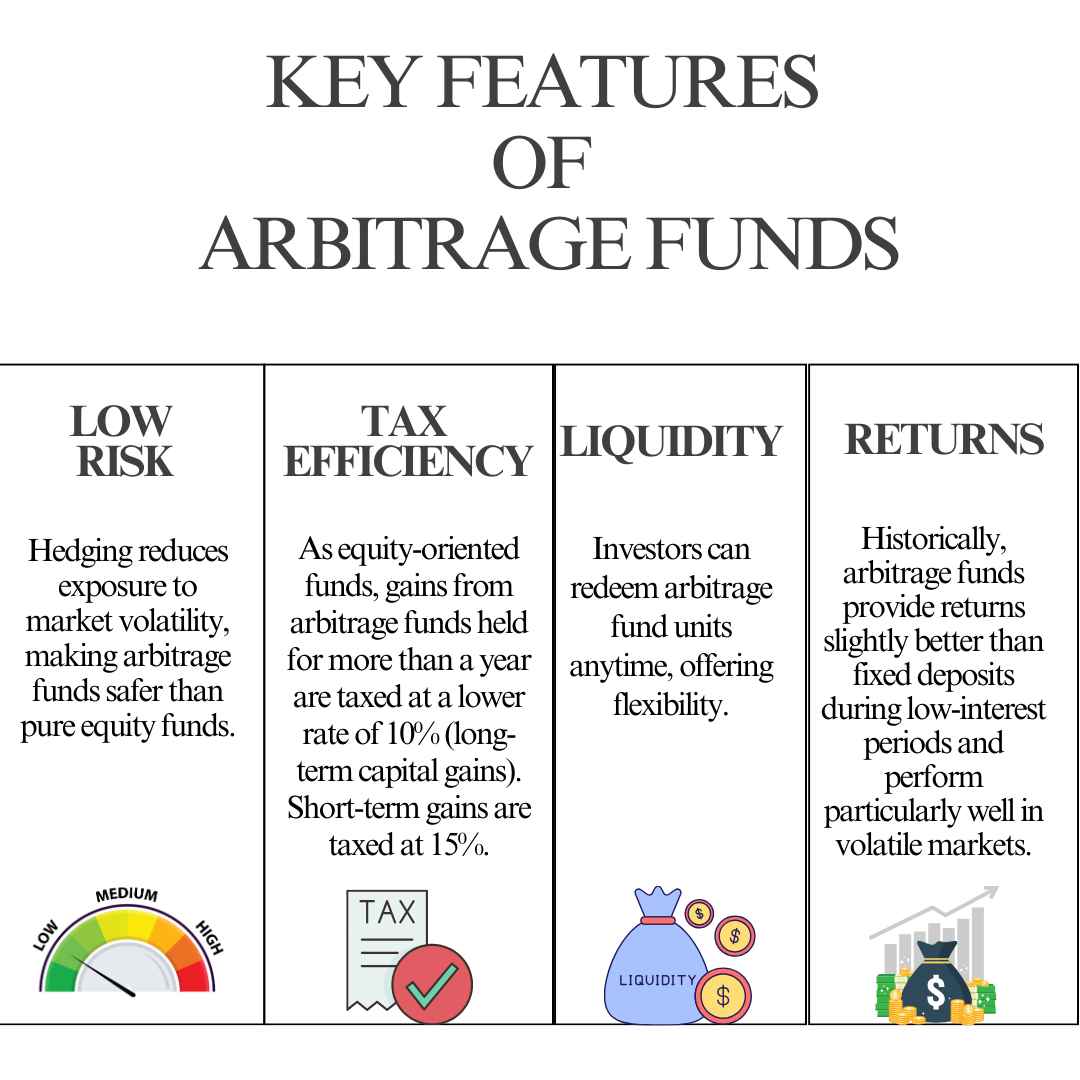

At the heart of this surge is the tax treatment arbitrage funds enjoy. Unlike traditional debt or liquid mutual funds, which are taxed at the investor’s full income tax slab, arbitrage funds are treated like equity for taxation purposes. This means short term capital gains are taxed at fifteen percent, and long term gains above one lakh rupees are taxed at just twelve and a half percent. For high net worth individuals and those in higher tax brackets, this creates an extremely attractive post tax return profile. But the appeal is not just about tax. Arbitrage funds are also considered low risk because they exploit pricing differences between the cash and derivatives markets, locking in small but relatively secure profits through simultaneous buy and sell strategies.

Industry leaders have noted how the current market environment is well suited for arbitrage strategies. According to Nikhil Rungta, Chief Investment Officer at LIC Mutual Fund, the spike in volatility has made arbitrage opportunities more abundant. During steady bull markets, price inefficiencies are less frequent. But in times like these, where stocks swing due to quarterly earnings or international developments, arbitrage opportunities become more common and profitable. These strategies thrive when cash futures spreads are healthy, and right now, those spreads are quite attractive. In addition, increased turnover in derivatives and higher open interest across market sectors have widened the playing field for fund managers deploying arbitrage tactics.

Another reason arbitrage funds are in demand is their relative performance. Over the past six months, they have delivered returns comparable to liquid funds, which are typically a go to for parking idle money. However, with liquid and other debt schemes facing major outflows, arbitrage has emerged as a safer yet smarter alternative. Arun Kumar, head of research at FundsIndia, believes the blend of income with arbitrage, often packaged as fund of funds schemes, is becoming a compelling product for cautious investors. Many fund houses have already launched such schemes, and others are planning to roll out similar offerings to meet the growing demand.

These hybrid funds aim to combine the safety of fixed income with the tax benefits and low risk returns of arbitrage. Devang Shah of Axis Mutual Fund says this combination offers a practical route for investors who want to preserve capital while still generating returns that beat inflation. He also emphasized how recent tax rules under the Finance Act of 2024 allow certain income plus arbitrage fund of funds schemes to qualify for more favorable tax treatment if they maintain a significant portion of their portfolio in arbitrage strategies.

The regulatory clarity on taxation has helped cement confidence in these funds. For those holding arbitrage fund units for at least two years, gains are taxed at a concessional twelve and a half percent after indexation benefits. This is a notable advantage compared to standard debt mutual funds, which are taxed at the individual’s slab rate regardless of the holding period.

While some industry watchers had speculated that the government might tighten the tax treatment of arbitrage schemes due to their unique positioning, that has not materialized so far. The funds continue to occupy a sweet spot between equity and debt, making them a rare hybrid that caters to investors who want low risk and high tax efficiency without committing to long term equity exposure.

As volatility remains the defining theme of today’s markets and traditional debt products become less appealing due to tax inefficiencies, arbitrage funds may continue to attract strong inflows. They are not just a temporary parking ground anymore but are increasingly seen as a core part of short term investment portfolios for savvy investors.

Follow You Finance on Instagram and Facebook to stay updated on the smartest investment trends and tax saving strategies that are reshaping personal finance in India today.