Why Companies Will Not Cut Prices Directly

Fast-moving consumer goods companies have informed the Central Board of Indirect Taxes and Customs that they cannot directly reduce the retail prices of low-value packs after the recent GST cuts. Items like biscuits, soaps, and toothpaste that are traditionally sold at Rs 5, Rs 10, or Rs 20 are unlikely to see lower sticker prices. Instead, manufacturers are preparing to increase the quantity offered in each pack while maintaining the same price.

The reasoning, company executives explain, is that Indian consumers are accustomed to buying items at round price points. A Rs 20 biscuit pack dropping to Rs 18 because of a tax cut may look logical on paper, but it disrupts the psychological comfort of familiar pricing bands. To avoid confusing consumers and disturbing established habits, companies prefer to adjust product weight or size instead of altering prices.

The Biscuit Example and Impulse Packs

FMCG companies plan to pass on GST rate cuts by increasing product volumes at popular price points rather than reducing sticker prices, citing consumer psychology and market dynamics.

Take the case of a biscuit pack priced at Rs 20, which previously included an 18 percent GST. With the new GST rate of 5 percent effective from September 22, the price should technically fall to around Rs 18. Executives argue that this is not a feasible price point for mass-market items. Instead, biscuit makers will increase the pack’s grammage while retaining the Rs 20 price tag.

Rishabh Jain, CFO of Bikaji Foods, confirmed that the company would adopt this approach for impulse packs, which are designed to encourage spontaneous purchases. By increasing the product size while keeping the price unchanged, companies ensure that consumers perceive greater value without disturbing psychological price brackets.

Government Response and Oversight

Officials in the Finance Ministry are aware of this approach and are considering issuing guidelines to ensure that GST benefits are effectively passed on to consumers. While companies argue that they are fully passing on the benefit through increased volume, regulators want to avoid the possibility of unintentional profiteering. There is currently no formal mechanism to monitor this, but discussions are underway about introducing one if required.

Dabur India CEO Mohit Malhotra has assured that consumers will benefit from the rate cut, as it is expected to trigger higher consumption levels. The industry as a whole agrees that the tax reduction will help stimulate demand in everyday products, even if the benefits appear in the form of larger pack sizes rather than lower sticker prices.

Expert Opinions on the Impact

Namit Purit, Managing Director and Senior Partner at BCG, believes that price movements in the FMCG sector will be modest. According to him, companies are more likely to enhance value by adjusting pack sizes at key price points rather than cutting or raising prices sharply. He predicts that Rs 5 and Rs 10 packs will offer consumers noticeably more value through higher quantity while maintaining familiar pricing.

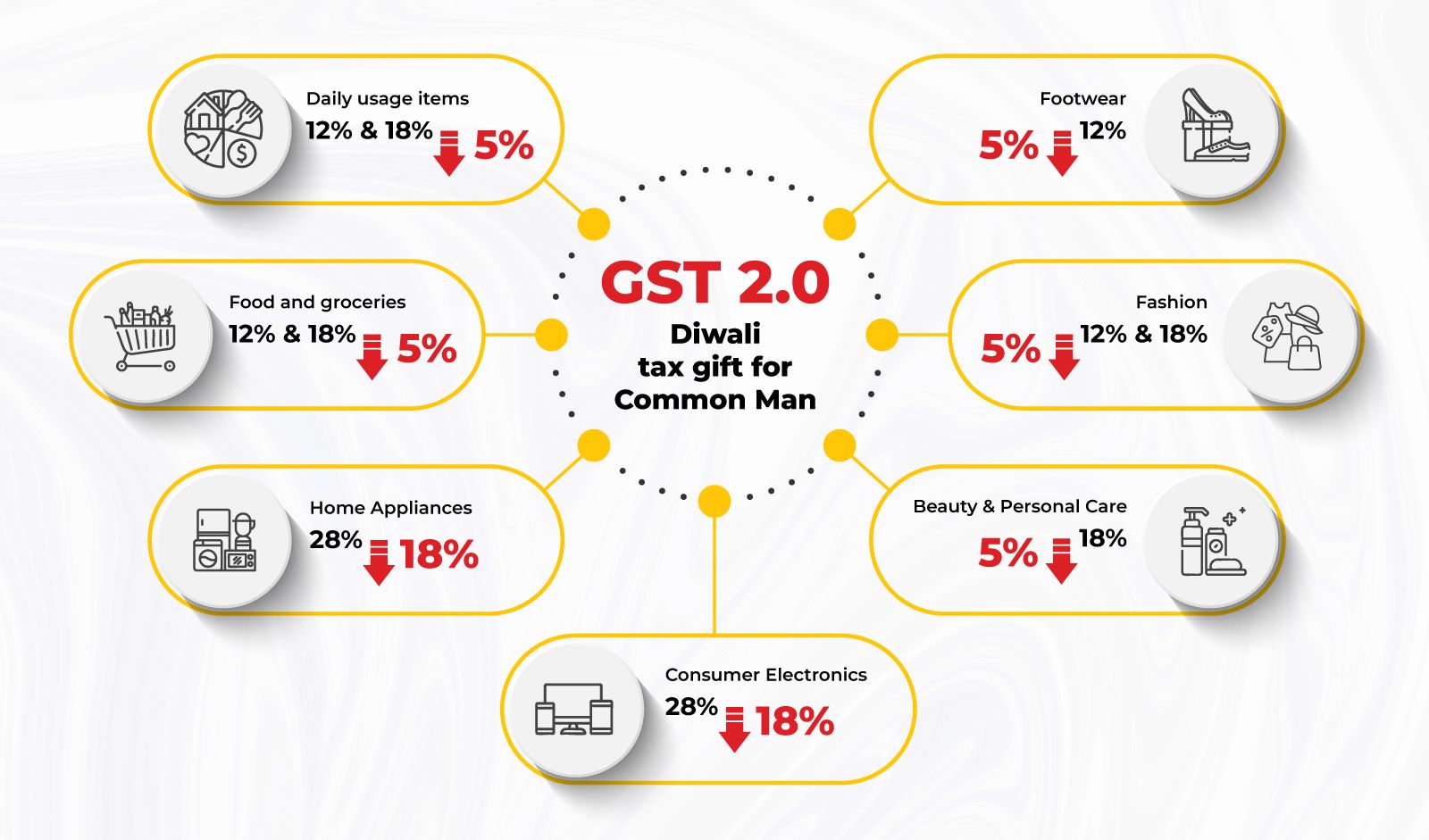

The Bigger GST Picture

The GST Council recently simplified the indirect tax system by restructuring slabs. Most daily-use items have been moved into the 5 percent category, with a standard 18 percent slab and a special 40 percent de-merit rate for select goods. The move is part of a broader effort to streamline taxation and reduce consumer costs. For the FMCG sector, which thrives on affordability and consistency, the challenge is to translate tax benefits into consumer value without disrupting established buying patterns.

Conclusion

FMCG companies are preparing to deliver the GST benefit to consumers in their own way, by giving more for the same price rather than cutting MRPs. This approach reflects a deep understanding of consumer psychology and the practical realities of India’s mass-market economy. While regulators may still step in with guidelines, the strategy ensures that consumers experience the impact of GST cuts in terms of enhanced value.

Follow YouFinance on Instagram and Facebook for more updates on how GST reforms, market strategies, and consumer trends are shaping India’s economy.