Adding to its growing list of tax troubles, Eternal, the parent company of food delivery platform Zomato and quick commerce service Blinkit, has received a ₹128 crore GST demand and penalty order from the Uttar Pradesh State Tax Department. The order cites alleged short payment of output tax and excess use of input tax credit between April 2023 and March 2024.

The Demand Order In Detail

The order, issued by the Deputy Commissioner of State Tax in Lucknow, includes a GST demand of ₹64.2 crore, along with an equivalent penalty of ₹64.2 crore, taking the total to ₹128.4 crore. Eternal revealed in its stock exchange filing that the order was received on October 18, 2025, and that it intends to appeal the decision, claiming a strong case based on merit.

The company said in its filing, “We have received an order confirming a GST demand of ₹64.2 crore with applicable interest and a penalty of ₹64.2 crore. We believe the order lacks merit and will be contesting it before the appropriate appellate authority.”

Growing List Of Tax Challenges

This latest order adds to a series of tax-related disputes faced by Eternal over the past two years. The company has already dealt with multiple GST demands across different states, including Maharashtra, Tamil Nadu, Karnataka, and West Bengal.

In 2023, Maharashtra authorities raised Eternal’s largest ever GST demand of ₹401.7 crore. This was followed by fresh notices throughout 2024 and 2025 — with Tamil Nadu issuing a ₹4.6 crore order, West Bengal ₹17.7 crore, and Karnataka ₹40 crore. Just two months ago, Uttar Pradesh authorities had also issued a smaller ₹1.3 crore notice.

Financial Impact And Performance

The latest GST notice arrives soon after Eternal’s Q2 FY26 financial results, which showed a sharp 63 percent year-on-year decline in consolidated net profit to ₹65 crore. However, revenue surged 183 percent year-on-year to ₹13,590 crore, driven primarily by the rapid growth of Blinkit.

Blinkit’s shift to an inventory-led model has dramatically boosted its revenue, reaching ₹9,891 crore in the quarter — a ninefold increase compared to last year. The expansion of dark stores across key cities has also accelerated its logistics operations but increased costs significantly.

Meanwhile, Zomato’s core food delivery business continues to face growth challenges due to subdued consumer spending and competition from the quick commerce boom.

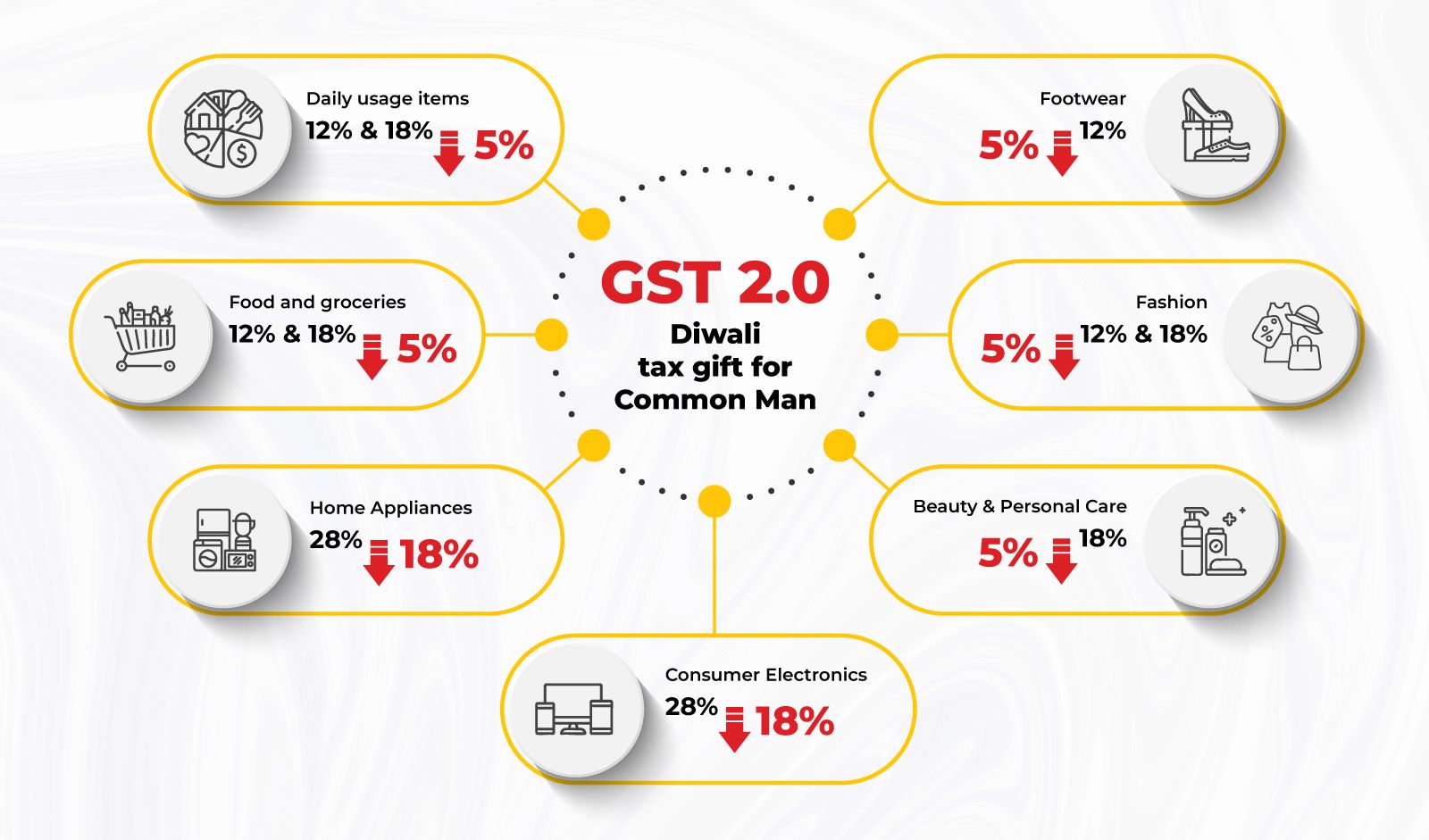

GST 2.0 Adds More Pressure

The company is also navigating the impact of the new GST 2.0 framework, which introduced the “local delivery services” category. Under this regulation, food delivery companies must now pay 18 percent GST on delivery fees for non-GST registered partners. Eternal’s CFO, Akshant Goyal, mentioned that this policy has slightly reduced order volumes, as the company decided to pass the additional tax burden to customers.

Eternal’s Position And Outlook

Despite ongoing tax pressures, Eternal maintains that it has complied with all GST norms and will continue to defend its position in each case. The company stated that it remains committed to transparency and legal compliance while focusing on scaling its fast-growing business segments.

As of the latest Muhurat Trading session, Eternal’s stock closed marginally lower at ₹338.05. The outcome of the GST appeal will likely be closely watched by investors and industry experts, given the significant financial implications and the ongoing regulatory scrutiny faced by India’s leading tech unicorns.

Follow You Finance on Instagram and Facebook for more updates, analysis, and insights into India’s evolving business and financial landscape.