The global semiconductor industry is undergoing a dramatic shift and India has placed itself firmly on the map. With the Indian Semiconductor Mission allocating ₹76,000 crore in incentives, the country is aiming to become a crucial player in the global chip supply chain. The first big milestone was the Micron project in Sanand, Gujarat, which brought in more than ₹22,000 crore worth of investment to set up a packaging and testing facility. Since then, more projects have been approved, including new ventures in Bhubaneswar and Jewar, marking a clear intent to scale capacity. While Micron and other global players grab headlines, there are Indian companies working behind the scenes that could benefit massively from this semiconductor push. Three names stand out: Kaynes Technology, CG Power, and VA Tech Wabag.

![]()

Kaynes Technology: The Silent Giant of Chip Packaging

Kaynes Technology has been around for more than thirty years, known for integrated electronic manufacturing that supports industries ranging from aerospace to railways. Its big move into semiconductors is happening through a subsidiary, Kaynes Semicon, which is setting up a ₹3,300 crore facility in Sanand. This plant will handle outsourced semiconductor assembly and testing, producing up to sixty lakh chips every single day. The company has already signed a deal with Alpha and Omega Semiconductor to secure demand for its first phase of production, while also exploring partnerships with global heavyweights such as Intel, Qualcomm, and Broadcom.

From an investor’s perspective, Kaynes is showing financial strength with a strong order book and nearly fifty percent year-on-year profit growth in the latest quarter. However, its high valuation and the absence of dividends raise questions about whether the stock offers value at current levels. Its future success will depend on scaling production without compromising quality, and on keeping its margins intact while moving into advanced chip designs.

CG Power: A Legacy Player with a Future in Semiconductors

CG Power has been part of India’s industrial story for more than eight decades. Known traditionally for power systems and industrial solutions, it is now venturing into chipmaking through a joint venture with Renesas Electronics of Japan and Stars Microelectronics of Thailand. Together, they are investing more than ₹7,600 crore in an advanced semiconductor packaging plant in Sanand. Once complete, this facility will be able to manufacture fifteen crore chips per day.

What makes CG Power unique is its capability to produce both legacy and advanced chip packages, which are vital for industries ranging from consumer electronics to artificial intelligence. Its diversification into this space has already started reflecting in its financials, with the semiconductor division contributing new revenue streams. Supported by government subsidies and its own industrial expertise, CG Power is positioning itself as a critical link between India’s manufacturing base and the global semiconductor ecosystem.

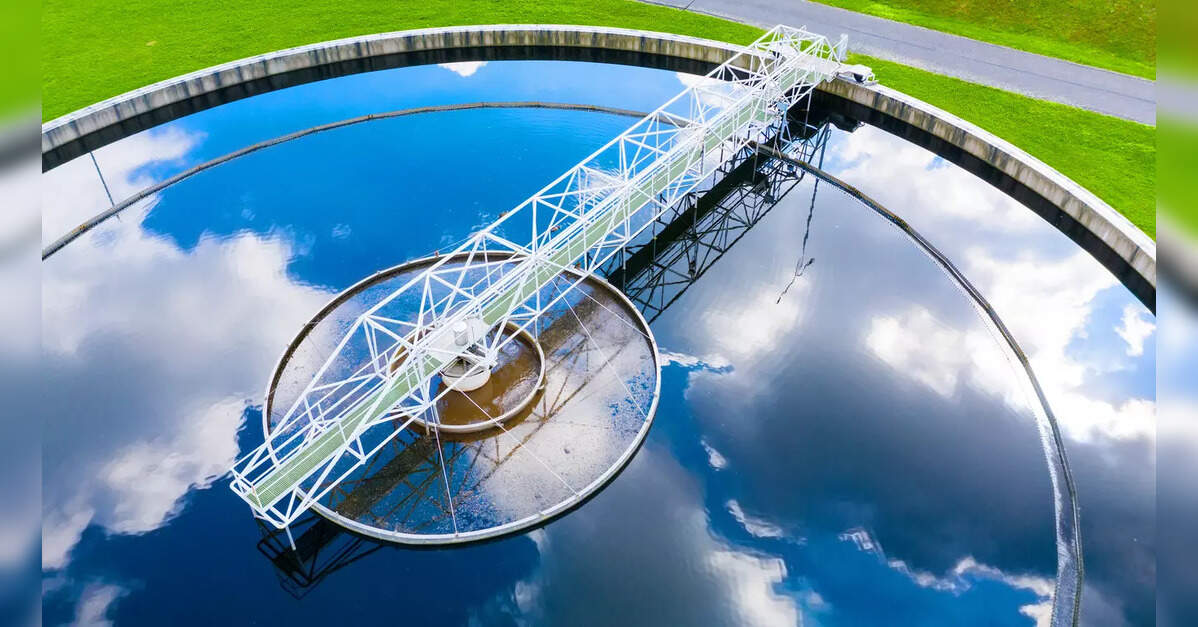

VA Tech Wabag: Water is the New Oil for Chipmakers

While Kaynes and CG Power deal directly with semiconductors, VA Tech Wabag plays a different but equally vital role. Chip fabrication is one of the most water-intensive industrial processes in the world. To manufacture chips, companies need ultra pure water that is thousands of times cleaner than drinking water. VA Tech Wabag, a global leader in desalination and wastewater treatment, has the expertise and infrastructure to meet this demand.

Although it does not yet supply directly to semiconductor manufacturers, its plants in Gujarat and its experience in international projects make it a strong contender. As more chip fabs come up in India, the demand for pure water will only increase, creating an opportunity for Wabag to step in as a critical enabler. With recent multi-crore contracts in India and abroad, its financial performance has been strong, and investors are beginning to look at it as a play on the semiconductor boom through an indirect but powerful route.

The Bigger Picture

India’s semiconductor story is still in its early stages, but the direction is clear. Geopolitical shifts, such as the US-China tech rivalry and Taiwan’s growing vulnerability, are forcing global chipmakers to diversify. India is using this moment to push its China-plus-one strategy, supported by strong government incentives and a growing base of capable companies. For investors, this does not just mean looking at global giants but also keeping an eye on the Indian firms quietly building the supply chain.

Final Thoughts

The semiconductor sector is one of the most promising stories of India’s growth over the next decade. Companies like Kaynes Technology, CG Power, and VA Tech Wabag may not grab headlines the way Micron does, but they represent the deeper foundation of this boom. For investors willing to look beyond the obvious, these companies could provide exposure to one of the most exciting structural shifts in India’s economy.

Follow You Finance on Instagram and Facebook for more insights, market stories, and financial wisdom designed to help you stay ahead in the world of money.